Discover how Generative AI is transforming customer feedback into actionable sentiment analysis in banking. This expanded use case builds on Ajit Mishra’s original article, “Banking 3.0: 10 Generative AI Ideas Reshaping the Industry,” published on Medium.

Table of Contents

Introduction

The hyper-personalized era of Banking 3.0 mandates a unified customer experience that is no longer a “nice-to-have” option—it’s the primary battleground for competitive differentiation. Traditional customer feedback mechanisms like NPS or CSAT surveys offer only a surface-level view. Enter Generative AI–powered sentiment analysis—a game-changing approach that captures, understands, and acts on the emotional pulse of customers across every digital interaction.

This expanded use case is inspired by the original thought leadership article, “Banking 3.0: 10 Generative AI Ideas Reshaping the Industry”, authored by Ajit Mishra, a pioneering voice in AI-driven digital transformation.

In this use case, we’ll break down how Banking CAIOs can drive real-time, scalable, and multilingual sentiment intelligence across voice, text, social, and CRM channels—delivering measurable ROI while rehumanizing digital banking experiences.

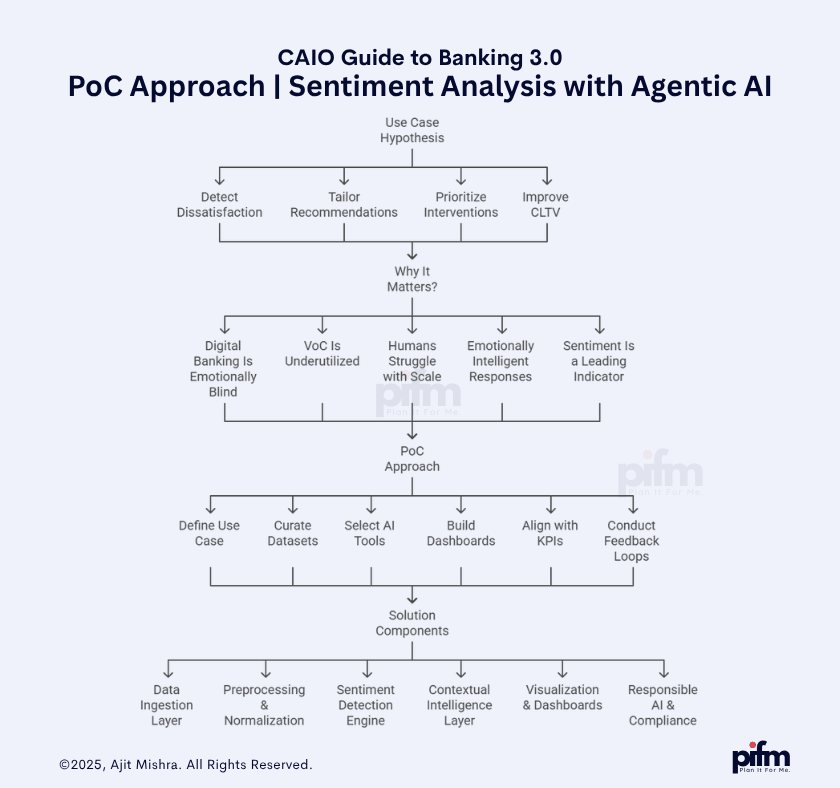

Use Case Hypothesis

If a bank can capture, analyze, and act on customer sentiment in real time across all interaction channels—such as voice calls, chat transcripts, emails, surveys, mobile app reviews, and social media posts—then it can redefine customer intimacy and operational precision in the following ways:

1. 🛑 Detect Dissatisfaction Before Churn

By monitoring real-time shifts in customer tone, word choice, and emotion, the system can proactively flag early warning signs of frustration, confusion, or disappointment. These indicators often precede account closures or complaints. Generative AI can surface these micro-signals from a sea of noise—long before they escalate into churn.

Example: A customer using terms like “disappointed,” “again,” or “not resolved” across multiple channels within a week signals likely attrition. The AI can alert the retention team instantly, triggering a customized recovery journey.

2. 🎯 Tailor Product Recommendations Based on Sentiment

Customer sentiment reveals more than satisfaction—it exposes underlying needs, life changes, or aspirations. A sentiment-aware AI can blend emotional data with transactional history to surface hyper-relevant product offerings.

Example: A customer praising their recent travel experience might be nudged with a tailored travel credit card offer or an international wallet plan, precisely timed to their emotional high.

3. 🚨 Prioritize Agent Interventions Intelligently

Contact centers typically operate on “first-come, first-served” or SLA-based models. A sentiment-driven approach reimagines this by triaging queries based on emotional urgency, enabling agents to respond first to those in distress or confusion.

Example: A high-value customer expressing anger or using negative sentiment in a chatbot is routed to a Level 2 live agent instead of being passed around in automated loops.

4. 💰 Improve Overall Customer Lifetime Value (CLTV)

Banks that continuously adapt to customers’ emotional feedback can build deeper trust, drive loyalty, and increase wallet share. By acting empathetically and in real-time, banks foster meaningful relationships that go beyond transactional value.

Example: Emotionally satisfied customers are more likely to recommend the bank, opt for bundled products, and stay engaged during upsell cycles—directly boosting CLTV.

Why It Matters?

Customer sentiment isn’t just a reaction—it’s a real-time strategic asset. In a world where banks increasingly operate as platforms, not just institutions, the ability to understand emotion at scale becomes a superpower. Here’s why it’s crucial:

1. 📱 Digital Banking Is the New Normal—But It’s Emotionally Blind

With over 90% of banking interactions now digital-first, customers rarely walk into a branch or call a relationship manager. Instead, they leave emotional breadcrumbs across chatbots, app reviews, surveys, and social comments. Traditional analytics tools miss this nuance. Generative AI enables banks to finally “listen with empathy” across digital channels.

Stat Insight: According to McKinsey, banks that excel at digital experience are 2.5x more likely to retain customers over five years.

2. 🧩 Voice-of-the-Customer (VoC) Is Siloed and Underutilized

Feedback lives across CRM systems, IVR logs, surveys, Twitter threads, and Google Play Store reviews. Each platform has a different tone, format, and intent. Without AI, unifying these fragments into a coherent emotional narrative is impossible. Gen AI-powered sentiment models can ingest and contextualize diverse feedback streams, enabling a single source of truth for VoC.

Real-World Example: A negative app review may coincide with a poor support chat experience, but without integration, the pattern goes unnoticed.

3. 🧠 Humans Struggle with Scale—AI Doesn’t

Even the most diligent quality teams can review only a small sample of calls or messages. But GenAI models trained on thousands of interactions per day can spot patterns, surface rare edge cases, and learn continuously. More importantly, AI never gets fatigued or biased by a bad day.

AI Advantage: A single model can monitor every call transcript and every chat log, tagging anomalies and opportunities that even your best agents might miss.

4. 💥 Emotionally Intelligent Responses Drive Business Outcomes

According to Forrester, emotionally engaged customers are three times more likely to recommend a brand. By responding with the right tone, timing, and intent—banks can transform simple service interactions into trust-building moments.

Illustration: Instead of sending a templated email post-complaint, a sentiment-aware GenAI could generate a personalized, empathetic message acknowledging the customer’s frustration and offering a goodwill gesture—like fee reversal or reward points.

5. 🧮 Sentiment Is a Leading Indicator—Better Than Surveys

NPS and CSAT are lagging indicators. They tell you what has already gone wrong. Sentiment, on the other hand, is real-time and behavior-linked. It offers predictive power to prevent churn, identify up-sell windows, and fine-tune messaging.

Use Case: A pilot program at a mid-size bank showed a 27% higher correlation between negative sentiment and churn risk than with traditional CSAT scores.

PoC Approach

A well-executed Proof of Concept (PoC) is the best way to validate the feasibility, accuracy, and ROI of sentiment analysis using Generative AI. The goal is not to boil the ocean but to design a low-risk, high-impact experiment that proves value in 4–6 weeks. Here’s how Banking CAIOs can orchestrate it:

✅ 1. Define a Controlled Use Case

Start with a narrow slice of customer interactions where sentiment has direct business implications. Ideal PoC candidates:

- Call center transcripts from the loan servicing team

- Chatbot conversations for credit card queries

- App store reviews for the mobile banking app

- Email support tickets from the wealth management desk

Choose a use case that has:

- Clear customer pain points

- High volume of interactions

- Executive visibility (for faster buy-in)

📂 2. Curate and Preprocess Relevant Datasets

Pull data from existing repositories such as:

- Salesforce, Zendesk, or Freshdesk (for emails/tickets)

- Amazon Connect or NICE (for call transcripts)

- Mobile analytics (App Store / Play Store reviews)

- Chat logs from Intercom, LivePerson, or Drift

Ensure:

- Anonymization and masking of PII

- Language normalization (multilingual inputs mapped to English or native models)

- Speaker diarization for calls (to isolate customer vs agent voice)

- Deduplication and topic segmentation

Target dataset size: 10,000–50,000 records for statistical relevance.

🤖 3. Select the Right AI Tools and Models

Options include:

| Strategy | Tools/Models |

|---|---|

| API-based (Quickest) | OpenAI, Google Cloud NLP, AWS Comprehend, IBM Watson NLU |

| Open Source (Customizable) | LLaMA 2, Falcon, Mistral + Hugging Face Transformers |

| Fine-tuned Banking LLMs | FinBERT, BloombergGPT, Claude for Financial Services |

Enhance with:

- Emotion classification (anger, joy, fear, etc.)

- Tone & intent detection

- Topic modeling (using BERTopic, LDA)

📊 4. Build Sentiment Dashboards with Actionable Views

Use a BI tool (Power BI, Tableau, Looker Studio, or Streamlit) to visualize:

- Sentiment trends over time

- Top 5 positive/negative keywords

- Heatmaps by product, geography, agent, and channel

- Drill-down view into flagged conversations

- Churn risk scores based on aggregated sentiment

Bonus: Integrate Slack/Teams alerts when negative sentiment spikes in a particular channel.

🧠 5. Align Outcomes with Business KPIs

Your PoC must map AI insights to clear business benefits. Define these 4 metrics upfront:

| Metric | Description | Measurement |

|---|---|---|

| Accuracy | Precision of sentiment tagging | Manual audit of 500 samples |

| Churn Prediction | % of churn cases with prior negative sentiment | CRM + historical analysis |

| NPS Uplift | Change in NPS score after applying GenAI insights | Before/after comparison |

| Speed to Insight | Time saved in analyzing VoC manually | Baseline vs AI time |

🔁 6. Conduct Feedback Loops & Human-in-the-Loop Evaluation

- Create a panel of customer success managers and QA agents to review AI-labeled sentiments

- Use feedback to fine-tune model thresholds and prompts

- Adjust prompt design in GenAI models for better nuance (e.g., sarcasm, mixed sentiment)

🚀 Sample PoC Timeline

| Week | Milestone |

|---|---|

| Week 1 | Use case finalization, stakeholder alignment |

| Week 2 | Data extraction and preprocessing |

| Week 3 | Model deployment and fine-tuning |

| Week 4 | Dashboard development and UAT |

| Week 5 | Executive demo + metric benchmarking |

| Week 6 | Business case validation + roadmap proposal |

🔐 Compliance and Risk

Don’t forget to address:

- Data residency (especially for cloud-hosted models)

- GDPR/CCPA consent if using real voice or email

- Bias detection in multilingual sentiment scoring

- Legal disclaimers for synthetic summaries

Solution Components

To build an enterprise-grade Sentiment Analysis Solution in banking, you need to stitch together multiple components across data, AI models, pipelines, and user-facing outputs. Here’s a full breakdown of the layered architecture—MECE-aligned and plug-and-play for CAIO deployment.

Disclaimer:

The tools, models, and platforms listed above are intended as illustrative and indicative options based on current market trends and AI capabilities. They do not constitute an endorsement or a one-size-fits-all solution. Each bank’s CAIO team must conduct rigorous due diligence, including technical feasibility assessments, data privacy compliance evaluations, cost-benefit analyses, and alignment with enterprise architecture standards, before implementing any solution. Selection should be guided by internal IT policies, regulatory frameworks, and the specific use case maturity level.

📥 1. Data Ingestion Layer

- Channels: Customer support tickets, chat transcripts, emails, voice calls, mobile app reviews, social media

- ETL Tools:

- Fivetran or Airbyte for syncing structured/unstructured data

- Google Cloud Pub/Sub for real-time data streaming

- AWS Kinesis for ingesting call transcripts and social feeds

- CRM Integrations:

🧹 2. Preprocessing & Text Normalization

- Tasks: Cleaning, tokenization, language detection, language translation, speaker separation (for calls)

- Toolkits:

- spaCy for language preprocessing

- NLTK for text tokenization

- Google Cloud Speech-to-Text with speaker diarization for voice data

- Amazon Transcribe for real-time speech-to-text

- Google Cloud Translation for multilingual input normalization

🧠 3. Sentiment & Emotion Detection Engine

- Core Model:

- Pre-trained LLMs such as OpenAI GPT-4, Claude by Anthropic, or Mistral

- Fine-tuned options like FinBERT (financial tone detection)

- APIs:

- Emotion Libraries:

- Hugging Face Transformers

- Text2Emotion

- Ekman’s Emotion Set for classifying anger, joy, sadness, etc.

🧰 4. Contextual Intelligence Layer (Optional but Powerful)

- RAG (Retrieval-Augmented Generation):

Combine customer context (e.g., last 10 transactions or complaint history) with real-time feedback to enhance LLM predictions - Tools:

- LangChain for RAG pipeline development

- Pinecone or Weaviate for vector databases

- LlamaIndex for knowledge graph integration

- Integrate with your Data Warehouse (BigQuery, Snowflake, or Redshift) to fetch metadata

📊 5. Visualization & Executive Dashboards

- Tools:

- Power BI or Tableau for enterprise-grade dashboards

- Google Looker Studio for quick, lightweight prototypes

- Streamlit or Dash by Plotly for custom analytics front-ends

- Widgets to include:

- Sentiment heatmap by region/product/agent

- NPS vs Sentiment correlation tracker

- Emotion spike alerts (automated to Slack/MS Teams)

- Top trending keywords (positive/negative)

🔐 6. Responsible AI & Compliance Layer

- Bias Auditing Tools:

- Aequitas or Fairlearn for fairness audits

- WhyLabs AI Observatory for observability

- Explainability Tools:

- Security & Privacy:

- PII redaction with AWS Macie or Google DLP

- Audit logs through Azure Purview or Collibra

This modular approach allows for incremental scaling, where banks can start with 2–3 channels and expand to full omnichannel sentiment intelligence over time. Most tools listed above have generous free tiers or pilot pricing to make PoC affordable.